If you invested $1,000 in Bitcoin at the start of 2025, here’s what it’s worth now

After the market-wide cryptocurrency bull run kicked off in November 2024, the upward trajectory of Bitcoin (BTC) stalled out in late December.

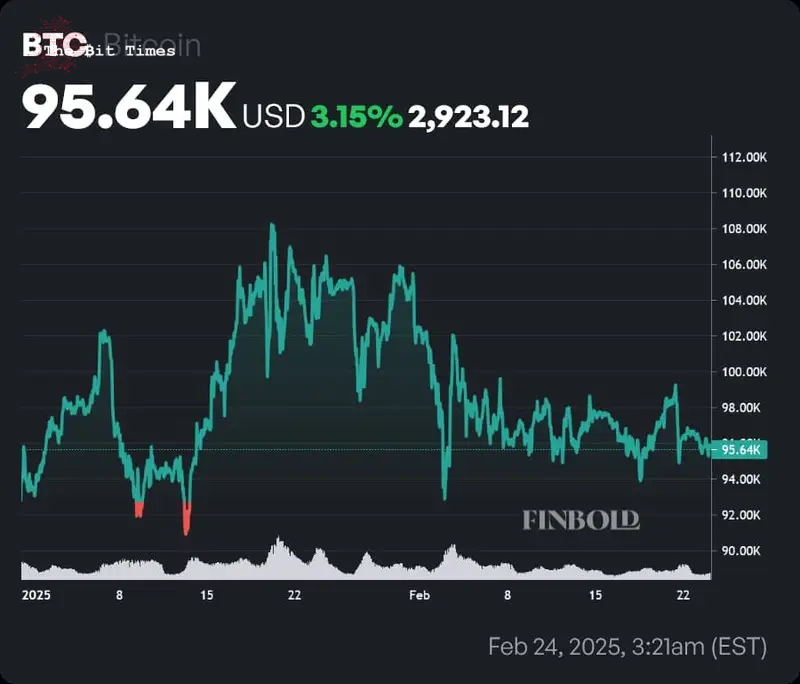

Although a renewed rally saw a new all-time high (ATH) of $108,786 reached on January 20, prices managed to hold above the $100,000 mark just until the end of the month — when President Trump’s implementation of tariffs caused a market-wide selloff of risk assets.

The leading cryptocurrency has been trading sideways since; although this time around, the level of support has solidified higher than before, at $96,500.

Picks for you

Investing $1,000 in Bitcoin at the start of the year would have netted investors a relatively modest return by February 24. On January 1, BTC was changing hands at a price of $92,880. Despite the humble uptick seen, that price point still represents quite an attractive entry point when looking at the long term.

$1,000 invested in Bitcoin on January 1 would now be worth 3% more

On the whole, since the start of the year, the price of Bitcoin has increased by 3.15%, up to $95,640 at press time.

Accordingly, a $1,000 investment made at the start of the year would be worth $1,031.5 at the time of publication — in other words, it would have made a $31.5 profit.

However, since the leading digital asset began exhibiting significant volatility as early as late December, finding a more attractive entry point would not have been particularly hard.

Since the beginning of 2025, BTC has seen two significant dips in price. The two troughs saw prices reach low points of $91,910 and $90,900 on January 9 and January 13, respectively.

Making a $1,000 investment at those price points would have netted a 4.05% or 5.21% return — this would translate to an investment worth $1,040.5 and $1,052.1 at the time of publication — or, in other words, a $40.5 and $52.1 profit, respectively.

Readers should note, however, that these are ultimately short-term snapshots of the premier cryptocurrency’s price action. While it is important to note dissenting voices, analysts generally remain quite bullish amid a backdrop of increasing institutional adoption and a U.S. administration that is largely seen as pro-crypto. In addition, as covered by Finbold, technical analysts have recently outlined a case for a renewed surge to $107,000 — although it would most likely entail another dip to $91,000 before bullish momentum resumes.

Featured image via Shutterstock

Comments

Post a Comment