Here’s why Bitcoin price could correct after the US government resolves the debt limit impasse

For much of 2022, the crypto market focused on the U.S. Federal Reserve's actions. The central bank created a bearish environment for risk-on assets like Stocks and Cryptocurrencies by increasing the Interest Rates on borrowing.

Toward the end of 2022, positive economic data, healthy employment numbers and a decreasing inflation rate provided hope that a much-awaited slowdown in the rate of interest rate hikes would occur. Currently, the market expects the rate hikes to reduce from 50 basis points (bps) to 25 bps before the complete end of the hike regime by mid-2023.

From the perspective of the Fed's goal of constraining liquidity and providing headwinds to an overheated economy and stock market, things are starting to improve. It appears that the Fed's plan of a soft-landing by quantitative tightening to curb inflation without throwing the economy into a deep recession might be working. The recent rally in stock markets and Bitcoin can be attributed to the market's trust in the above narrative.

However, another essential American agency, the U.S. Treasury, poses significant risks to the global economy. While the Fed has been draining liquidity from the markets, the Treasury provided a countermeasure by draining its cash balance and negating some of the Fed's efforts. This situation may be coming to an end.

It invokes risks of constrained liquidity conditions with the possibility of an adverse economic shock. For this reason, analysts warn that the second half of 2023 may see excess volatility.

Backdoor liquidity injections negate the Fed’s quantitative tightening

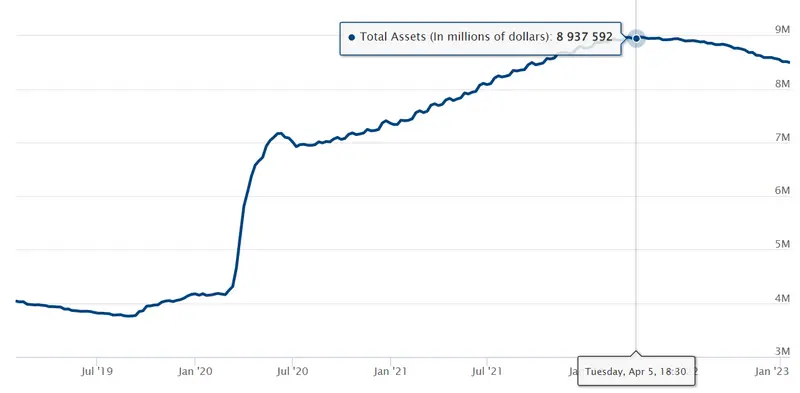

The Fed started its quantitative tightening in April 2022 by increasing the interest rates on its borrowings. The aim was to reduce inflation by constraining the market's liquidity. Its balance sheet shrank by $476 billion during this period, which is a positive sign considering that inflation dropped and employment levels stayed healthy.

However, during the same time, the U.S. Treasury used its Treasury General Account (TGA) to inject liquidity into the market. Typically, the Treasury would sell bonds to raise additional cash to meet its obligations. However, since the nation’s debt was close to its debt ceiling level, the federal department used its cash to fund the deficit.

Effectively, it’s a backdoor liquidity injection. The TGA is a net liability of the Fed’s balance sheet. The Treasury had drained $542 million from its TGA account since April 2022, when the Fed began rate hikes. Independent macro market analyst, Lyn Alden, told Cointelegraph:

“U.S. Treasury is drawing down its cash balance to avoid going over the debt ceiling, which is adding liquidity into the system. So, the Treasury has been offsetting some of the QT that the Fed is doing. Once the debt ceiling issue gets resolved, the Treasury will be refilling its cash account, which pulls liquidity out of the system.”

Debt ceiling issue and potential economic fallout

The U.S. Treasury's debt totaled approximately $31.45 trillion as of Jan. 23, 2023. The number represents the total outstanding of the U.S. government accumulated over the nation's history. It is crucial because it has reached the Treasury's debt ceiling.

The debt ceiling is an arbitrary number set by the U.S. government that limits the amount of Treasury bonds sold to the Federal Reserve. It means that the government can no longer take on additional debts.

Currently, the U.S. has to pay interest on its National Debt of $31.4 trillion and spend on the welfare and development of the country. These expenditures include salaries of public medical practitioners, educational institutions, and pension beneficiaries.

Needless to say that the U.S. government spends more than it makes. Thus, if it can't raise debt, there'll have to be a cut in either Interest Rate payments or government expenditures. The first scenario means a default in U.S. government bonds which opens a big can of worms, starting with a loss of trust in the world's largest economy. The second scenario poses uncertain but real risks as failure to meet public goods payment can induce political instability in the country.

But, the limit is not set in stone; the U.S. Congress votes on the debt ceiling and has changed it many times. The U.S. Treasury Department notes that "since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents."

If history is any indication, the lawmakers are more likely to resolve those issues by raising the debt ceiling before any real damage is done. However, in that case, the Treasury would be inclined to increase its TGA balance again; the department's target is $700 billion by 2023 end.

Either by draining out its liquidity completely by June or with the help of a debt ceiling amendment, the backdoor liquidity injections into the economy would come to a close. It threatens to create a challenging situation for risk-on assets.

Bitcoin’s correlation with stock markets remains strong

Bitcoin’s correlation with the U.S. stock market indices, especially the Nasdaq 100, remains near all-time highs. Alden noted that the FTX collapse suppressed the crypto market in Q4 2022 when the equities rallied on slower rate hike expectations. And while the congress delays its decision on the debt ceiling, favorable liquidity conditions have allowed Bitcoin’s price to rise.

However, the correlation with the stock markets is still strong, and movements in S&P 500 and Nasdaq 100 will likely continue influencing Bitcoin’s price. Nik Bhatia, a financial researcher, wrote about the importance of the stock market’s direction for Bitcoin. He said,

“…in the short term, market prices can be very wrong. But over the more intermediate term, we have to take trends and trend reversals seriously.”

With the risks from the ongoing Fed’s quantitative tightening and stoppage of Treasury liquidity injections, the markets are expected to stay vulnerable through the second half of 2023.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Comments

Post a Comment